Call Us Now

We are professional Real Estate Investors that buy, renovate and sell property for profit. Our high-yield lending opportunity is the perfect resource to earn the returns you deserve.

Response time is one of the most important factors in acquiring acceptable properties. Access to private lenders allows us to purchase the property paying "All Cash", giving us a much better opportunity to secure the deal. It also allows us to avoid conventional bank financing which can be time consuming and frustrating. We pay higher rates to our private lenders compared to bank loans because the access to capital outweighs the higher cost to us.

As the private lender you will have a mortgage on the property we are rehabbing. You essentially become the bank and are given the same protection the bank receives.

Our bank is currently paying less than .5% for a 12-month CD. $100,000 invested at an annual rate of .5% is $500. As an example, that same $100,000 invested with us at 10% will earn you $10,000 over the same 12 months. That's an additional $9,500 within the same time period!

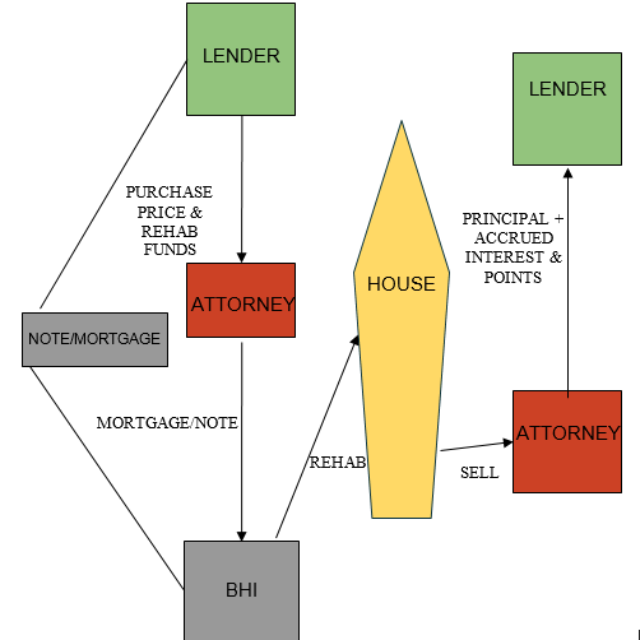

The transaction process is simple and is outlined in the adjacent flow chart.

Lorem ipsum dolor sit amet, consectetur adipisicing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur. Excepteur sint occaecat cupidatat non proident, sunt in culpa qui officia deserunt mollit anim id est laborum.

Learn more about investing in real estate deals. If you are interested in having us contact you, fill out the form on this page. See below for common questions and answers.

We can certainly do much better than your typical CD or money market account. Usually the returns are several times the return you're currently getting.

No. We prefer there only be one payment of all principal and accrued interest paid when the loan is paid (when we sell the property). That way, there are no hassles and accounting is simpler. For our business, it helps with cash flow. For you, it makes things less complicated. You make the loan and then, after we've fixed and sold the property, you get a check with the prinicpal and all accrued interest.

We typically request the loan term to be 1 year. However, most loans will be paid within 6-9 months as that is usually all the time we need to fix and sell each property.

The short term of the loans we get should make the turn around pretty quick which should avoid this situation. If you feel you might need the money sooner than the loan term, we prefer you didn't lend the money.

Stock prices drop all the time...and by considerable amounts. Home values don't typically decline in the same way and definitely not with the same speed. Homes will always have value as people will always need a place to live. We are buying, all in, for below 70% of market value. This pretty much assures the loan amount will be less than the home value, which protects the loan.

Hopefully this isn't something that we need to worry about (I'm in great health), but something we should cover just to be safe. You will have a secured loan. The loan is secured by the property. In the event something happens to me, my family and associates will likely be able to sell the property and pay the loan. In the event that doesn't happen, you can foreclose and sell the house yourself. You're covered.

No. One loan per property is all we allow. You will be in first position.

Typically, we need between $50,000 to $300,000. The exact amount depends on the deal (what we buy it for and the amount needed to fix it up).

We don't fit banks mold. They want something that fits their cut and dry formulas. Houses needing repairs don't typically fit their lending criteria. They also take forever and we have to be quick when buying these houses at deep discounts. We are better off paying higher returns to have a simpler loan process and faster closings to keep us competitive.

Yes. You will just need to move it to an administrator who will allow you to invest. We can help you with this.

Absolutely. We would be happy to talk with them.

The documents you will receive are a Real Estate Note, a Mortgage (recorded with the county and sent to you afterward), an insurance binder showing you as mortgagee and a title insurance policy.

Enter Answer Here

Enter Answer Here

Enter Answer Here